The small details can take your outfit from plain to polished. When you're wearing a dinner suit, the right accessories...

Every medical lab works better with the right tools in place. From testing to storing, each item plays a part...

At first glance, a shop in an airport may look like any other. But the way it’s built, laid out,...

Many people are drawn to the calm, peaceful feel of dining by the water. Whether it’s the sound of boats,...

Many patients often have questions about the cost of dental implants, and it can be a sensitive topic to discuss...

Operating a business without a valid license in Dubai can lead to severe consequences that may severely impact your venture....

Cruise ships offer a luxurious and enjoyable way to travel, but ensuring the safety of passengers is paramount. With thousands...

Female gynecologists offer a wide range of services that cater to the unique needs of women, from preventive care to...

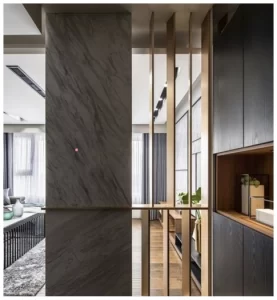

Selecting the right turnkey interior solutions help ensuring a smooth transformation of your space. Turnkey interiors Dubai solutions offer an...

Renting a sound system for an event can vary widely in cost, depending on several factors including the size of...